6 Steel Industry Events Affecting Your Steel Pails

As we start 2024, it’s hard to believe some of the major stories developing within the steel industry, the biggest being the potential sale of US Steel to Nippon Steel.

We experienced above forecasted volume for January, so please plan your orders accordingly.

Here are a few stories we’re watching closely:

- US STEEL BUYOUT IS TRANSFORMATIVE FOR NIPPON STEEL AND THE NORTH AMERICAN MARKET | CRU

- NEW US SHEET CAPACITY WILL INFLUENCE 2024 CONTRACTS | CRU

- SMU PRICE RANGES: SHEET MIXED AS MARKET AWAITS POST-HOLIDAY DIRECTION

- SMU SURVEY: STEEL BUYERS SENTIMENT INDICES SLUMP TO START 2024

- CLEVELAND-CLIFFS ANNOUNCES PRICE INCREASE FOR HOT ROLLED, COLD ROLLED AND COATED STEEL PRODUCTS

- REPORT: NIPPON STEEL SEES CLEAR SKIES AHEAD FOR USS DEAL

US STEEL BUYOUT IS TRANSFORMATIVE FOR NIPPON STEEL AND THE NORTH AMERICAN MARKET | CRU

The recent agreement for Nippon Steel Corp (NSC) to acquire US Steel (USS) marks a significant shift in the steel industry. Expected to finalize within two to three quarters, pending regulatory and stakeholder approvals, this deal positions NSC as a major player in the US market and elevates it to the world’s third-largest steelmaker.

Valued at $14.1 billion in equity, nearly double Cleveland Cliffs’ earlier offer, and an enterprise value of $14.9 billion, the transaction is seen as on the higher end of valuations but includes expectations of future growth. USS’s ongoing projects contribute to this valuation, with a full EBITDA run rate in 2026 projected at $880 million.

This acquisition, avoiding further industry consolidation, is expected to foster a competitive steel market in the USA, crucial for manufacturing sectors reliant on steel. The interest from multiple companies in USS suggests a potential rise in mergers and acquisitions (M&A) within the industry.

While the NSC buyout process may face challenges from unions and politicians, NSC’s existing operations in the USA and its commitment to low-emission steelmaking are likely to mitigate these concerns, maintaining the deal’s momentum towards completion.

Read more here.

NEW US SHEET CAPACITY WILL INFLUENCE 2024 CONTRACTS

The US flat rolled steel market is witnessing an intensification in annual contract negotiations, with both buyers and mills eager to secure volumes for the next year. A significant shift in the market is the increase in supply amidst limited demand growth.

This change is primarily due to the gradual online progression of new Electric Arc Furnace (EAF) mills, which has been slower than anticipated. As these new capacities become operational, mills are employing conservative strategies to introduce their products to the market, careful to avoid overwhelming the spot market.

Established mills are responding by solidifying their positions through extended or multi-year contracts, avoiding direct price competition with the emerging capacities. The expected outcome for 2024 is a decrease in sheet prices due to increased EAF supply, coupled with a rise in demand for scrap, leading to a narrower spread between hot-rolled coil and prime scrap prices compared to previous years.

The structuring of annual contracts is a critical aspect of both procurement strategies for buyers and commercial strategies for mills. Most contracts, particularly in the non-automotive sector, are variable in nature and often pegged to market prices, with CRU’s index being a popular benchmark.

Another prevalent model is the cost-plus contract, especially at EAF-based mills, which links prices to scrap costs plus additional factors. These contracts offer benefits in terms of long-term volume commitments and hedging against variable costs, but they might not always reflect market trends accurately. For instance, if the spread between hot-rolled coil and prime scrap prices diminishes, those on scrap-based contracts might find themselves paying more than those on market-based contracts.

This scenario gains importance for businesses where cost-effectiveness in steel procurement is crucial. The right procurement strategy in 2024 should involve diversifying supply sources and purchase methods to effectively navigate the steel industry’s supply chain risks, considering both scrap-based and market-based contracts and possibly exploring spot market opportunities.

Read more here.

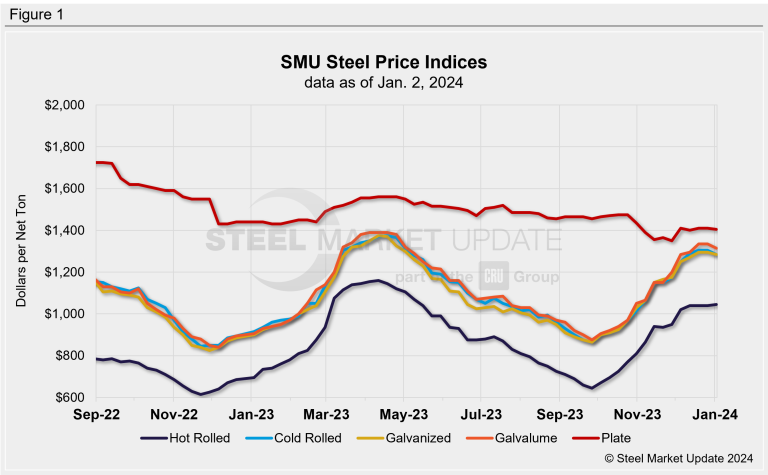

SMU PRICE RANGES: SHEET MIXED AS MARKET AWAITS POST-HOLIDAY DIRECTION

In the latest market assessment by Steel Market Update (SMU) at the start of 2024, there was a mixed trend in sheet prices.

While hot-rolled coil (HRC) prices saw a modest increase. The average price of HRC is now at $1,045 per net ton, reflecting a slight rise of $5 from the December assessment.

SMU has adjusted its sheet price momentum indicator to neutral for the first time since early October, indicating uncertainty about future price movements.

Read more here.

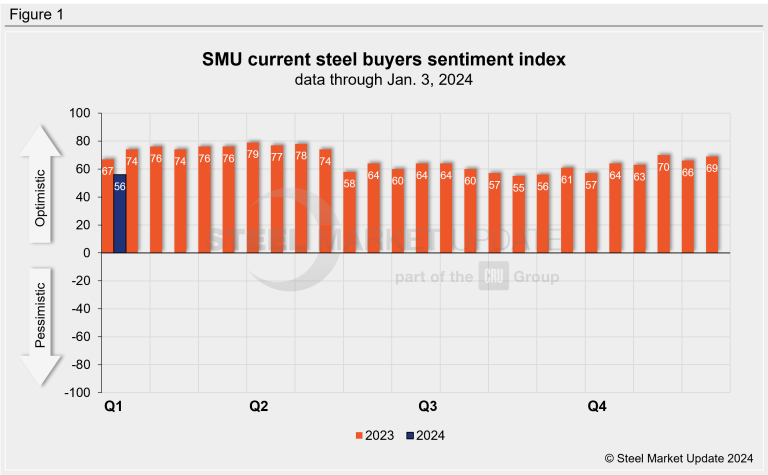

SMU SURVEY: STEEL BUYERS SENTIMENT INDICES SLUMP TO START 2024

Steel Market Update’s (SMU) Steel Buyers Sentiment Indices have shown a notable decline at the beginning of the new year, as reflected in their most recent survey.

The Current Buyers Sentiment Index experienced a significant drop, falling 13 points to +56, a level last seen in mid-September and down from +67 at the start of 2023.

Survey respondents commented on a range of issues, from being well-positioned for the first quarter of 2024 to challenges like rising costs, a robust spot market, and an increase in demand in January compared to lower holiday shipments.

Read more here.

CLEVELAND-CLIFFS ANNOUNCES PRICE INCREASE FOR HOT ROLLED, COLD ROLLED AND COATED STEEL PRODUCTS

Cleveland-Cliffs has recently declared an immediate increase in the current spot market base prices for their entire range of carbon steel products, including hot rolled, cold rolled, and coated variants, applicable to all new orders.

The company has set a new minimum base price for hot rolled steel at $1,150 per net ton.

Read more here.

REPORT: NIPPON STEEL SEES CLEAR SKIES AHEAD FOR USS DEAL

Nippon Steel’s President Eiji Hashimoto, as reported by Reuters, expressed confidence in the successful completion of their proposed acquisition of U.S. Steel.

Hashimoto emphasized that the deal would align with the economic security strategies of the United States and Western nations, causing no harm to America. He assured that the existing labor agreement with the United Steel Workers (USW) union would be respected. However, the acquisition has faced some opposition, including concerns from US politicians and the White House calling for thorough scrutiny.

The USW also expressed reservations about the deal after discussions with Nippon Steel, indicating a preference for Cleveland-Cliffs as the buyer.

Read more here.

So what do all these events mean for your steel pails?

Overall, it appears that we’re beginning to experience pricing pressures from the steel mills. While we’re not anticipating significant material shortages, it seems likely that price reductions may not be feasible in the near future. Additionally, I anticipate that labor shortages will persist into 2024, which could result in prolonged lead times.

If you have any questions about an upcoming pail order, don’t hesitate to contact your sales manager!